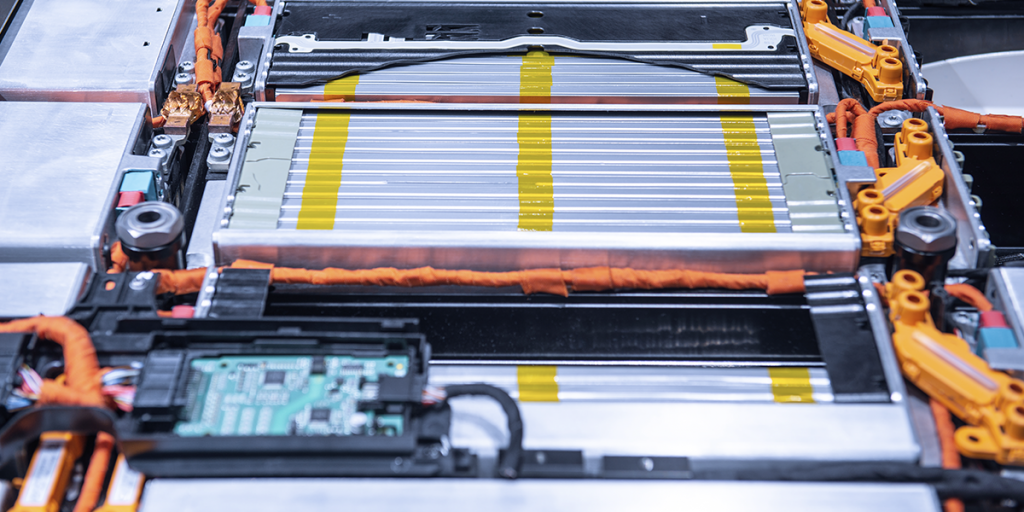

This mineral is the main component of batteries for electric cars, and its production is essential for the mobility of the future. For this reason, some countries work to nationalize their reserves or find deposits to exploit them, through state-owned or private enterprises.

A few months ago, the news went unnoticed, despite its importance. Andrés Manuel López Obrador, the president of Mexico, promised in Sonora that he would nationalize lithium reserves of more than 230,000 hectares. The exploitation of this mineral in the northern state, essential for the batteries in electric cars, would be declared as being under state ownership.

In reality, this gesture was more symbolic than effective. This Central American country is not among the largest producers of the mineral, but López Obrador was sending a clear message: having the country’s reserves in public custody is a good way to prepare for what lies ahead. Lithium is the element that designs the future. And whoever has it does not want to miss the train to the green transition.

All eyes are on this mineral and the soil where it is found. The largest reserves, in fact, are in the United States, Australia, China and the Latin American triangle formed by Bolivia, Chile and Argentina (between the three they make up to 80% of the world’s supply). That is what all companies and governments are focusing on. There is even a project in the making in the vicinity of Cáceres, in Spain. But at the moment it is just that, a project, and the population is divided: on the one hand, it would generate jobs, and on the other, there are concerns about the environmental impact.

Those who have no doubts are the members of the so-called lithium triangle, located in the middle of an extensive plain that covers a good part of what is known as the Arid Diagonal of South America, on the western flank of the continent. This territory boasts unique geological features. And there —among the Hombre Muerto, Antofalla and Arizaro (Argentina), the Atacama (Chile) and the Uyuni salt flats (Bolivia)— the multinationals are bidding for control of the mines.

There is a lot at stake: in the lithium triangle there is as much lithium as there is oil in Saudi Arabia. And the demand does not stop growing. According to the Statista data platform, in 2019 it reached 263,000 tons, which rose to 327,000 in 2020 and 465,000 in 2021. According to their calculations, in 2030 2.1 million tons will be demanded. And it will continue to rise: just look at the recent European ban on the sale of diesel and gasoline vehicles by 2035.

Lithium is extracted by separating it from the rocks it forms part of and from mineral waters. The main minerals from which it is extracted are lepidolite, petalite, spodumene, and amblygonite

Because of this, many countries are deciding what to do. The nationalization announced in Mexico may spread to other latitudes and lands are being scoured to find deposits that can be exploited through private or public enterprises. The mines in Chile and Argentina, for example, operate under a private initiative. In the case of Bolivia, the one in charge of doing so is the public company Yacimientos de Litio Bolivianos, which has had a monopoly since 2008. All these companies export lithium to countries in the European Union and superpowers such as Russia and China.

Other places in the world also have lithium, although in smaller quantities. Australia has 5.7%, China 1.5% and the United States 0.9% of the world’s supply. Although this is nothing like those in the South American triangle, it allows these countries to play a part in the lithium market.

This also happens with Spain, for example. It is not a huge player, but it has a juicy enclave. Just two kilometers from the center of Cáceres is the largest lithium deposit on the peninsula and the second largest in all of Europe. Its exploitation rights are owned by the Australian multinational Infinity Lithium and it has been at a standstill for years: the opposition of residents and environmentalists has postponed the start of the activity. As in other highly regulated countries, national awareness of environmental issues slows down the projects. Not everyone has this problem.

On the other hand, there is already talk of changing the model for something made from sodium chloride and alumina. But until then, there is still a long way to go: in 2022 around 11 million units were needed for electric cars and in 2023 it is expected that another 13 million will be needed, according to the 20% growth rate that has been seen for years.

As David Valls, director of Infinity Lithium in Spain, said to the specialized blog Pictet, “Lithium batteries will not only be a necessity for the next 10 years; they require huge investments from the automotive sector and will be needed for the next 30 to 40 years, at least.”